BUSINESS

Dr. Doyin Salami set to deliver an Annual real estate market report at the 6th Edition of Real Estate Unite Summit, Lagos Today and 24th Oct.

Published

7 years agoon

By

FAB.NG

The African real estate market is beginning to show signs of recovery and stability. In a fast-moving world, the real estate industry needs to adapt itself taking into account geopolitical, economic, societal and technological challenges.

The recent economic downturn has caused the real estate sector in Africa to fall below the projected 2.6 percent regional growth. The Economic indicators show that Nigeria is gradually coming out of recession. However, balancing short-term indicators with long-term structural change will reinstate investor confidence which is paramount to the success and continued growth recovery process of the sector, as driven by government reforms and policies. Other West African states are showing continued growth and democratic progress. Ghana’s GDP stood at 6.6% by the first quarter of 2017 according to IMF. Senegal, Gambia and Ivory Coast are also showing stable economies.

“The Nigerian economy finally seems to be coming out the recession. The impact on real estate markets, particularly in the retail space has been clear with many of the country’s larger shopping malls suffering from persistently high vacancy rates as footfall comes under pressure. The impacting on the confidence of retailers to expand is self-evident according to Tom Mundy Director, Research and Strategy, JLL, sub-Saharan Africa.

Against the backdrop of these pressing issues, industry leaders and investors will unite again for the 6th edition of their annual flagship real estate summit Real Estate Unite (REU) (www.realestateunite.com

“The game has changed. Been faced with this new reality, how do we create new sources of growth? Are we rethinking business strategies? What’s are the new roles and responsibilities? What entirely is NEW? Solutions will form the basis of this year’s conversations says Ruth Obih, Founder, Real Estate Unite and Chief Executive, 3INVEST

To throw a spotlight on the economy, Dr. Doyin Salami, foremost economist, professor at Lagos Business School and 2nd term CBN monetary policy committee member will through his keynote presentation give an insightful examination of key trends in the Sub-Saharan and global economy with a specific view towards the future direction over the short and medium terms, including the outlook for GDP growth, interest rates and currency performance.

On tackling global issues and its effects, JLL, one of the global leaders in real estate will make a key presentation highlighting the global issues, its effects and solutions for the real estate industry in Africa.

Other speakers at the conference sessions include: Yemi Idowu – Aircom; Valentine Ozigbo – CEO, Transcorp Hotels; Adeniyi Adeleye – Stanbic IBTC Bank; Obi Nwogugu, Africa Capital Alliance, Ronald Chagoury Jr. Vice President, South Energyx, Hakeem Oguniran – UPDC (Nigeria); Ernest Hanson – Beaufort Properties (Ghana); Tom Mundy – JLL (South Africa); Mustapha Njie – TAF Africa Global (Gambia); Andre Geday, Elalan: Micheal Chudi Ejekam, Bolaji Edu, Broll, Chinwe Ajene-Sagna: JLL, Funke Okubadejo, ACTIS.

REU Summit in partnership with W-Hospitality and HTI will launch a dedicated Hotel, tourism and leisure(HTL) meeting place for the hospitality community. Real Estate Unite HTL will connect global business leaders and local markets to invest in Nigeria. The key focus areas for this year’s conversations will include; Annual market and economic update; Global issues and effects on local markets; Emerging disruptors in African Real Estate; Housing Market; Ground breaking technologies built for Africa; SSA future cities and Infrastructure; Healthcare as the most important priority for improving SSA; Capital market trends; Overview of the Hospitality, Tourism and Leisure (HTL) sector in Africa; Retail Revolution; and Office market. Other features of the summit will include the launch of the Real Estate Unite Network (RUN), a platform designed to foster interaction between active local real estate investors, developers, lenders and policymakers with a view to identifying the right partners for your business and building high-value relationships.

“ 2017 Real Estate Unite Conference has been designed to offer the greatest possible value and flexibility to operators, owners, users and players in all sectors of real estate including the residential, office, retail, healthcare, hospitality, logistics, leisure and industrial sectors,” says Ruth Obih-Obuah, Chief Executive, 3INVEST.

As is the tradition, Real Estate Unite 2017 will also feature exhibitions of latest offerings from Real estate product/service providers to an involved audience (B2B) that includes developers, suppliers, service providers etc. and attracts a wider B2C audience that includes investors, homebuyers, occupiers etc.

Key sponsors at this year’s event include ACTIS, Eko Atlantic, JLL, UPDC, Aircom, Stanbic IBTC, Broll, Haven Homes, Elalan, Clifton Homes Ghana, Landwey Investment Ltd, EUC Homes and MP Infrastructure.

Established in 2012, Real Estate Unite is curated by 3INVEST an organization with an advocacy goal to educate, redefine and promote the Sub-Sahara African Real Estate industry, exposing its huge potential for inclusive growth.

Interested delegates can register at www.realestateunite.com

Meet REU 2017 Speakers

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

|

|

||||||||||||||||||||||||

You may like

-

7 Date Night Restaurants In Lagos To Try On Valentine’s Day

-

“Mami Wata” Ends The Year With A Cinematic Finale In Lagos

-

Davido’s Timeless Concert In Abuja Forms Partnership With Ibom Air For Enhanced Travel Experience

-

3X4 Gourmet Elevates Nigerian Street Food Culture At Lagos Celebration

-

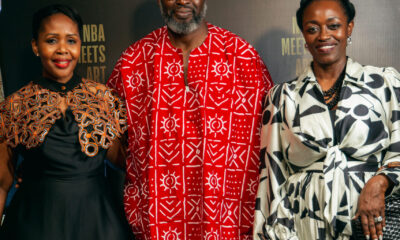

Check Out 2nd Edition Of ‘NBA Meets Art’

-

ART X Lagos Returns For It’s 8th Edition

Employment, or working for a living, can be a double-edged sword.

Sure, employment is a great way to achieve financial security and independence. It allows you to pay your bills, afford the things you need and want, and build a nest egg for the future. But let’s be honest, it also comes with challenges you might not expect when you’re first starting out.

Let’s explore these employment lessons below:

1. Startup costs can be a hurdle

You start a job to earn money, but you also need money upfront for things like professional work clothes, reliable transportation to get to and from work, and maybe even some basic office supplies. It can feel ironic that you invest your own money just to be able to make more money at your new job.

2. The Monday blues can hit hard

If you’re not passionate about your job and employment, Mondays can feel especially dreadful. It’s tough to be motivated and energised to tackle a long week of tasks you don’t enjoy, even if the work itself is relatively easy. This can affect your overall mood and productivity.

3. Making ends meet can be a constant juggling act

You work diligently every day, putting in your hours and effort. But depending on your employment salary, your paycheck might only come once a month.

This can make it challenging to budget effectively and ensure you have enough money to cover all your expenses throughout the entire month. It might require some creativity and financial planning to stretch your paycheck as far as possible.

4. Payday loans can become a trap

If you’re not careful with your money management and overspend throughout the month, you might find yourself broke before your next paycheck arrives. It can be tempting to resort to payday loans or credit cards to cover your essential expenses until payday.

However, these options often come with high interest rates and fees, which can trap you in a cycle of debt and make it even harder to manage your finances in the long run.

5. Your well-being is paramount

When you’re desperate for a job and trying to get your foot in the door, you might downplay the importance of work-life balance and readily agree to work under pressure on your resume. But a job that constantly stresses you out and takes a toll on your mental health might not be worth it in the long run.

There are some things money can’t buy, like peace of mind, good health, and strong relationships. It’s important to get employment that offers a healthy work-life balance and doesn’t come at the expense of your well-being.

6. The side hustle can be a lifesaver

When your income from your main job isn’t enough to cover your bills and your desired lifestyle, you might find yourself brainstorming ways to make more money on the side.

This could involve starting a freelance business, taking on a part-time gig, or exploring other avenues to supplement your income.

The extra income can help you achieve your financial goals faster, reduce financial stress, and give you more breathing room in your budget.

7. Health truly is wealth

One unexpected illness or injury can wipe out your savings quickly. Medical bills and medications can be very expensive, and even basic health insurance might not cover everything. This makes staying healthy even more important.

Taking preventative measures like eating healthy, getting regular exercise, and getting enough sleep can help you avoid costly health problems down the road.

8. Relaxation is key to avoiding burnout

If you don’t take breaks and prioritise relaxation, you might get sick, which can be a financial burden due to missed workdays and medical bills.

It’s important to schedule time for vacations, hobbies, and activities that help you de-stress and recharge. A well-rested and relaxed employee is a more productive and resilient employee in the long run.

9. Sometimes privacy is necessary

Depending on your social circle and financial situation, you might try to hide the fact that you have a job, especially if people around you constantly ask for money.

You might avoid them to escape the pressure to lend them money or give financial handouts. This can be a way to protect your financial security and avoid feeling taken advantage of.

10. Appreciation for your parents grows

Seeing how quickly money comes and goes can make you appreciate your parents more. You realise it wasn’t easy for them to provide for you when you were younger.

They likely had to make sacrifices and manage their finances carefully to make ends meet. This newfound understanding can bring you closer to your parents and give you greater respect for their hard work.

Even though having employment has its challenges, it doesn’t mean being unemployed is better. Life can be tough, but you can learn to develop strong financial habits, find a job that aligns with your values, and prioritise your well-being to navigate the complexities of working life.

For more articles like this, visit here.

BUSINESS

Thinking Of Investing In Money Market Funds? Check These Out!

Published

2 weeks agoon

May 4, 2024

Many people looking for safe places to invest their money, like money market funds. These funds are like pools of money from many investors that are used to buy very safe short-term loans. This means you get your money back quickly, and there’s a low chance of losing it.

The money market fund also pays you a bit of interest on your money, but not as much as some other investments. Before you decide to put your money in a money market fund, there are some things you should think about to make sure it’s a good fit for you.

Consider these factors before investing in money market funds

1. What are you hoping to achieve, and how much risk are you okay with?

Before choosing a money market fund, think about your goals. Are you looking to keep your money safe (capital preservation), easily access it when needed (liquidity), or earn a small amount of interest (modest return)? Knowing your goals will help you pick the best fund for you.

Money market funds are generally considered safe, but there’s still a small chance of losing money. Consider how much risk you’re comfortable with.

2. Fees and expenses

Like any investment, money market funds have fees. These fees are usually shown as a percentage called the expense ratio. This covers things like management fees, administration costs, and other expenses.

Shop around and compare expense ratios between different funds. Lower fees mean you get to keep more of your returns. Also, watch out for any additional fees, like charges for buying or selling shares, which can also reduce your returns.

3. What the fund buys and how good it is

Money market funds buy short-term loans from different sources, like the government, businesses, and banks. These loans are called Treasury bills, commercial paper, and certificates of deposit (CDs).

It’s important to see what kind of loans the fund is buying and how good they are. Look for funds that buy high-quality, easy-to-sell loans from reliable sources. Avoid funds that buy too many risky or hard-to-sell loans, as this makes the fund riskier.

4. How much interest you earn and how the fund has done in the past

Money market funds typically don’t pay as much interest as other investments like stocks or bonds, but it’s still a good idea to compare interest rates between different funds. See how the fund has done in the past to get an idea of its performance.

Remember, past performance doesn’t guarantee future results, but it can give you a clue about how the fund has done before.

5. The risk of not getting your money back

Even though money market funds invest in safe loans, there’s still a small chance that the borrower might not be able to repay the loan. This is called credit risk.

To minimise this risk, look for funds that buy loans from very creditworthy borrowers and consider funds with high ratings from credit rating agencies like Standard & Poor’s or Moody’s.

6. How easy it is to get your money out

One of the benefits of money market funds is that you can easily get your money back when you need it. However, some funds make it easier than others.

Find out about the fund’s rules for getting your money out and any minimum amount you need to invest. Make sure the fund allows you to access your money as easily as you need to.

7. How safe is the fund, and are the rules fair?

There are rules in place to protect investors and keep money market funds stable. Stay informed about any changes to these rules that might affect the funds. Choose a fund that follows good business practices and the established rules.

The world of international trade relies heavily on efficient and safe shipping. However, this process isn’t without its risks. From unpredictable weather to damaged cargo, unforeseen events can disrupt deliveries and cost businesses money. Here are some key tips to help you manage shipping risks and ensure your goods reach their destination smoothly:

Pre-shipment Planning

- Choose the Right Partner: Selecting a reputable and reliable shipping company is crucial. Look for companies with experience in your specific cargo type and familiarity with your destination. Research their track record, safety standards, and insurance offerings.

- Pack Securely: Proper packaging is essential to protect your cargo from damage during transport. Use high-quality packing materials that can withstand potential rough handling and varying weather conditions. Consider using dunnage (protective materials like packing peanuts or bubble wrap) to fill empty spaces and prevent items from shifting during transit.

- Accurate Documentation: Ensure all documentation is complete and accurate. This includes commercial invoices, bills of lading (a legal document outlining the contract of carriage), packing lists, and any necessary certificates (e.g., fumigation certificates for certain goods). Errors in documentation can lead to delays or even the seizure of your shipment at customs.

- Insurance: Shipping insurance provides financial protection against loss or damage to your cargo during transport. Consider the value of your goods and the potential shipping risks involved when choosing an insurance policy.

Risk Mitigation During Transit

- Track Your Shipment: Most shipping companies offer real-time tracking tools. Monitor your shipment’s progress to identify any potential delays or issues early on.

- Communicate Effectively: Maintain clear communication with your shipping partner, the consignee (the recipient of the goods), and any third-party logistics providers involved. Timely updates and clear communication can help address problems quickly and minimise disruptions.

- Contingency Plans: Be prepared for unexpected events. Develop contingency plans to address potential issues like bad weather, port congestion, or political unrest that might delay your shipment. Consider alternative shipping routes or modes of transport if necessary.

Post-Shipment Considerations

- Customs Clearance: The arrival of your goods at the destination port requires clearing customs. Familiarise yourself with the import regulations of the destination country to avoid delays. You may need to work with a customs broker to navigate the clearance process.

- Cargo Inspection: Be prepared for the possibility of your cargo being inspected by customs officials at the destination port. Ensure all documentation is readily available to facilitate a smooth inspection process.

- Damage Claims: If your cargo arrives damaged, promptly file a claim with your shipping insurance provider. Document the damage thoroughly with photos, and keep copies of all relevant documents for the insurance claim process.

Additional Tips

- Diversify Your Routes: Don’t rely on a single shipping route. Consider diversifying your routes to minimise the impact of disruptions in specific regions.

- Technology Integration: Utilise technology to streamline your shipping processes. Many shipping companies offer online booking, tracking, and document management tools.

- Stay Informed: Keep yourself updated on current events and potential disruptions that could affect shipping, such as changes in import regulations, weather forecasts, or political instability in certain regions.

By following these tips and proactively managing risks, you can ensure a smoother and more secure shipping experience for your business. Remember, effective risk management is an ongoing process that requires continuous evaluation and adaptation based on changing circumstances.

Get more business tips here.

Latest

“I’ll Pick Any Marvel Series” – Ruby Akubueze

Ruby Akubueze, a Nollywood actress, aspires to be part of any Marvel Studios project under Disney Entertainment. She gained recognition...

Stella Damasus Celebrates Second Daughter As She Graduates From Columbia University, Earns Full Scholarship To Top College

Nollywood actress Stella Damasus is bursting with pride. On May 14, 2024, she took to Instagram to celebrate her daughter Angelica’s...

Funke Akindele Announces An Upcoming Film “Finding Me”

Nollywood star Funke Akindele is drumming up excitement for her upcoming film project titled “Finding Me.” On May 14, 2024,...

How To Protect Your Brand Like Veekee James

Established fashion designer Veekee James recently shared some valuable wisdom with aspiring designers. In an Instagram post uploaded on May...

Tiwa Savage’s “Water and Garri” Makes Top 10 In 14 Countries

On May 13th, 2024, Tiwa Savage took to her social media platform to express her delight at the international success...

Police Arrest Portable Over G-Wagon Debt

Popular Nigerian musician Portable is facing legal trouble over an unpaid debt. The singer is known for his sometimes controversial...

Toyin Abraham Begs Fans Not To Bully Anyone In Her Name

Nollywood star Toyin Abraham took a stand against online bullying on May 14, 2024. The actress and producer specifically addressed...

“Stop Pitting Me Against My Friends” – BNXN Warns Fans

Nigerian music star BNXN is putting a stop to online comparisons. Influencer-fueled debates about who the better singer is, BNXN...

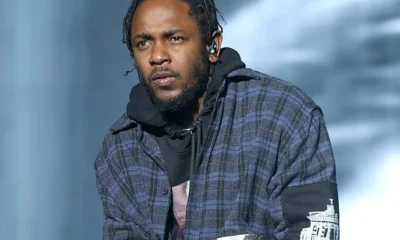

Kendrick Lamar’s “Not Like Us” Beats Drake’s “Family Matters” To Billboard #1 Spot

Kendrick Lamar‘s latest diss track, “Not Like Us,” has landed the coveted number-one spot on the Billboard Hot 100 chart....

10th AMVCA: See How Celebrities Rocked The Red Carpet

The annual African Magic Viewer’s Choice Awards (AMVCA) unfolded her 10th edition on May 11th, 2024, transforming Lagos’ Eko Hotel...

Top 5 Most Expensive Shoes In The World

Joeboy Fell In Love With Jemima Osunde In Short Film “Is My Love Not Enough”

Up NEPA: Documentary Film On Nigeria’s Electricity Sector To Premiere In FCT

How To Cook Nigerian Goat Meat Pepper Soup

How To Use Cloves & Rosemary Water For Hair Growth

Nigerians Who Attended The 2024 Met Gala

Calling Don Jazzy An Influencer Is Disrespectful – Mr. Macaroni Fumes At Wizkid

RMD Calls Out The Hypocrisy In Christianity

Does Garlic Really Increase Your Sex Drive?

Monique Drops New Single & Video “Ese Baba”

Trending

-

MUSIC6 days ago

MUSIC6 days agoYaba Buluku Boyz Talk About How Featuring Burna Boy Impacted Their Career

-

FOOD7 days ago

FOOD7 days agoHow To Make Yummy Coconut Candy With 3 Ingredients

-

ENTERTAINMENT5 days ago

ENTERTAINMENT5 days agoPrince Harry & Meghan To Arrive In Nigeria On Friday

-

ENTERTAINMENT5 days ago

ENTERTAINMENT5 days agoNigeria’s Dosunmu-Ogunbi Is First Black Woman To Bag PhD In Robotics At Michigan Varsity

-

DRINKS4 days ago

DRINKS4 days agoIs Zobo Drink Healthy For You? Check Out!

-

MOVIES2 days ago

MOVIES2 days ago“Ajosepo” Continues To Hold Top Spot After 4 Weeks In Cinemas

-

OPINION4 days ago

OPINION4 days ago5 Reasons Some Men Don’t Maintain Erection During Sex

-

TRAVEL3 days ago

TRAVEL3 days ago6 Most Beautiful Places To Visit In Lagos