LIFESTYLE

Meet the Power Women in Nigeria’s Financial Sector

Published

8 years agoon

By

Reporter

The Inspired By Glory (IBG) campaigns unveiled their latest campaign which features the most powerful women in Nigeria’s Financial Sector. Lets check them out. Also visit www.inspiredbyglory.com for more information about the Inspired by Glory campaigns.

ONIKEPO AKANDE OON CON

Onikepo Akande, OON, CON currently serves as the President of the Lagos Chamber of Commerce and Industry and honorary life Vice-President of the Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture. Nike became Nigeria’s first female Minister of Industry after she was appointed twice in December 1997 and August 1998. Described by President Goodluck Jonathan as “an inspiration”, she is also a board member of Union Bank of Nigeria and PZ Foundation and serves as the director of the National Insurance Corporation of Nigeria and the Nigeria Industrial Development Bank

Chief Mrs. Fadayomi is the Chairman African Prudential Registrars and is one of the Nigeria’s most well known Commercial Lawyers. She holds a LL.B Hons from the University of Lagos, and was called to Nigerian Bar in 1972. Her professional experience spans several years in both the Public and Private Sectors. She has served in the following high profile positions; the Attorney General and Commissioner for Justice of Lagos State; the first Commissioner for Women Affairs & Poverty Alleviation, as well as the Commissioner for Establishment, Training & Pensions at different times in the State.

In the Private Sector, she is the Principal Partner at Eniola Fadayomi & Co., and was the Legal Adviser to First Bank of Nigeria, Chairman Board of Directors, Afribank Nigeria PIc.

She currently serves on several boards, both in the Public and Private Sectors

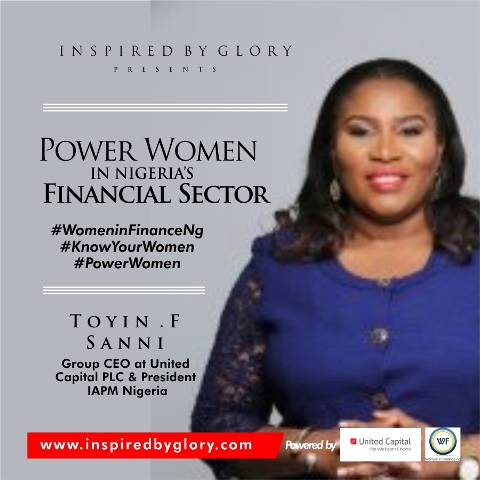

OLUWATOYIN SANNI Passionate about building wealth for Africans through provision of advisory and capital raising solutions, Toyin Sanni is currently the Group CEO at United Capital Plc, following previous roles as the CEO for UBA Trustees, UBA Global Investor Services and MD/CEO at Cornerstone Trustees Ltd and AGM, Trust Services at First Trustees (a subsidiary of First Bank of Nigeria Plc). Mrs Sanni is also the President of the Association of Investment Advisers & Portfolio Managers, Nigeria and Chairman of the Capital Market Committee on Financial Literacy Week. Her previous industry leadership roles also includes, Past President for the Association of Trustees and Chairman, CMC Sub-Committee on Custody of Securities.

Passionate about building wealth for Africans through provision of advisory and capital raising solutions, Toyin Sanni is currently the Group CEO at United Capital Plc, following previous roles as the CEO for UBA Trustees, UBA Global Investor Services and MD/CEO at Cornerstone Trustees Ltd and AGM, Trust Services at First Trustees (a subsidiary of First Bank of Nigeria Plc). Mrs Sanni is also the President of the Association of Investment Advisers & Portfolio Managers, Nigeria and Chairman of the Capital Market Committee on Financial Literacy Week. Her previous industry leadership roles also includes, Past President for the Association of Trustees and Chairman, CMC Sub-Committee on Custody of Securities.

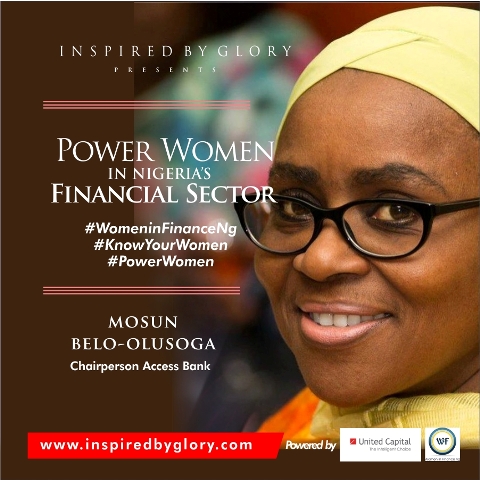

MOSUN BELO-OLUSOGA

Mrs. Mosun Belo- Olusoga is currently the Chairperson of Access Bank Plc and the Principal Consultant/Programme Director of The KRC Limited. She served on the Board of Asset and Resource Management Company and previously chaired the Equipment and Leasing Association of Nigeria.

Mrs. Belo-Olusoga retired from Guaranty Trust Bank in 2006 as Executive Director, Investment Banking. She was at various times responsible for Risk Management , Corporate and Commercial Banking, Investment Banking, Transaction Services and Settlement. She was also the Chairman of Credit and Finance Committee until her appointment as the Chairman of the Board in July 2015. She also served as a member of Audit, Governance and Nomination and Risk Management and Remuneration Committees. She joined the Board of Access Bank in November 2007.

Mrs. Belo-Olusoga is a fellow of both the Institute of Chartered Accountants of Nigeria and the Chartered Institute of Bankers of Nigeria. She graduated from University of Ibadan in 1979 with a Second Class Upper Degree.

IBUKUN AWOSIKA

Mrs Awosika is the Chairman, First Bank of Nigeria. She is the first woman to take up this position since the establishment of the bank. Before her appointment, she was a non-Executive Director of the Bank. Ibukun Awosika graduated with a bachelor’s degree in Chemistry from Obafemi Awolowo University, Ile-Ife and holds an MBA from IESE Business School, Barcelona, Spain. She is an alumna of the Lagos Business School Chief Executive Programme.

She is also a board member of the Women in Management and Business (WIMBIZ) and Convention on Business Integrity.

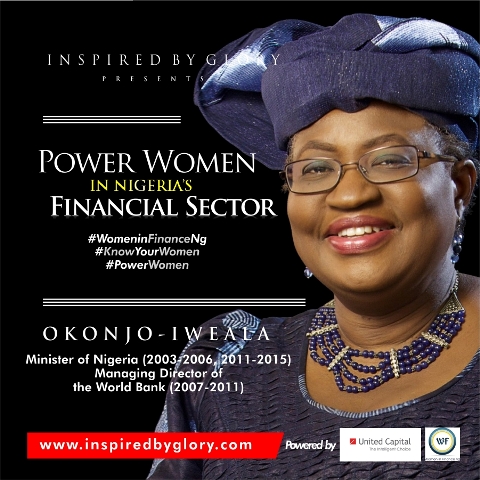

NGOZI OKONJO-IWEALA

Mrs. Okonjo-Iwela is a Nigerian and a highly respected and influential global leader, economist, policy maker and thinker on Finance and Economic Development. She has been listed 5 years consecutively as one of the 100 Most Powerful Women in the World by Forbes Magazine and in 2013 was listed as one of the Most Influential People in the World by TIME Magazine.In 2015, she was also listed as one of the 50 Greatest World Leaders by Fortune.

She served two terms as Finance Minister of Nigeria (2003-2006, 2011-2015) and was previously Managing Director of the World Bank (2007-2011).

Dr. Okonjo-Iweala is renowned as the first female and black candidate to contest for the presidency of the World Bank Group in 2012.

KEMI ADEOSUN

Kemi Adeosun is Nigeria’s Minister for finance. She qualified as a Chartered Accountant with the Institute of Chartered Accountants England and Wales in 1994. She commenced her career as an Accounting assistant at British Telecom Company, London, from 1989 till 1990 after which she moved to Goodman Jones, London, working as a Senior audit officer from 1990 till 1993.

She became Manager of Internal Audit at London Underground Limited, London and Prism Consulting from 1994 till 2000 before joining Price Waterhouse Coopers, London as Senior Manager from 2000 till 2002.

In 2002, Kemi became financial controller at Chapel Hill Denham Management and subsequently, Managing Director in 2010. After working with Quo Vadis Partnership as Managing Director in 2010 and 2011, she was appointed the Commissioner of Finance in Ogun State, from 2011 till 2015. She is currently the minister of finance of federal republic of Nigeria, from 2015 till date.

ARUNMA OTEH

Arunma Oteh is the Vice president and Treasurer of the World Bank. Prior to her appointment, she was the Director-General of the Securities and Exchange Commission of Nigeria where she led the transformation of the country’s capital markets industry into a major global presence. She was a member of the Board of the International Organization of Securities Commissions (IOSCO) and the Chairperson of the Africa Middle East Regional Committee of IOSCO.

Prior to joining the Securities and Exchange Commission (SEC) of Nigeria, Arunma was Group Vice President, Corporate Services, at the African Development Bank Group (AfDB). In this role, she oversaw a number of departments, including human resources, information and communications technology, and institutional procurement. From 2001 to 2006 she held the role of AfDB Group Treasurer, where she led AfDB’s fundraising and capital market activities across the world

OMOKEHINDE ADEBANJO

Omokehinde Adebanjo is the Vice President & Area Business Head for West Africa, MasterCard. In Nigeria, Omokehinde is responsible for advancing acceptance and issuance of MasterCard’s payment products in Nigeria and other English-speaking countries in West Africa.

Prior to her appointment as Area Business Head, she fulfilled the role of Vice President for Business Development in the West African region.

Before joining MasterCard, Omokehinde was employed by the Guaranty Trust Bank, where she spent four years as the Head of Cards and Product Development. She is committed to introducing the benefits of a cashless society to Nigeria and the region, and focuses on building relationships with government, financial institutions and merchants to realise both MasterCard’s vision of a world beyond cash, and the Central Bank of Nigeria’s goals to reduce the circulation of cash in the country’s economy.

SOLA DAVID-BORHA

Sola David-Bortha is the CEO of Stanbic IBTC Holdings PLC. She is fondly described as a woman with a strong personality and a high IQ. It has also been widely circulated that she is one of the highest paid CEOs in Nigeria.

Sola holds a B.Sc Economics degree from the University of Ibadan and an MBA from Manchester Business School, UK. Her educational experience also includes the Advanced Management Programme of the Harvard Business School. She is a fellow of the Chartered Institute of Bankers and Vice Chairman of the Nigerian Economic Summit Group.

Before her appointment as CEO, she previously served as Deputy CEO Stanbic IBTC Bank PLC among other appointments.

BOLA ADESOLA

Bola Adesola is the MD/CEO of Standard Chartered. She joined Standard Chartered as the MD/CEO in 2011 and in 2013. She was chosen as the winner of the “Outstanding Woman in Business” category at the Africa Business Awards 2013. Recently, the United Nations Secretary-General, Ban Ki-moon, announced her appointment as a member of the board of the United Nations Global Compact.

Before her appointment as MD/CEO Standard Chartered, she served with First Bank of Nigeria PLC as the Executive Director for Corporate Business then later was empowered to manage the entire company in Lagos including retail, corporate and commercial banking. She was the Managing Director at Kakawa Discount House Nigeria and worked in Citibank in Nigeria and Tanzania for 9 years.

TARIYE ISOUN GBADEGESIN

Tariye Gbadegesin is the Head of Heavy Industries and Telecommunications at the Africa Finance Corporation, an investment grade development finance institution for Africa. She is an investment and management professional with over 15 years of experience in the financial services sector, both internationally and in Nigeria.

Tariye was on the founding team to establish the Africa Finance Corporation and has over the years led and managed investments in the sectors of power, infrastructure, industrials as well as media & telecommunications. Tariye has worked at the International Monetary Fund, PricewaterhouseCoopers and Chase Manhattan Bank.

She is a non-executive Director on the Board of Cabeolica S.A, a wind power company in Cape Verde, an IFC ranked top 10 IPPs in Sub Saharan Africa. She is also a non-executive Director on the Board of the Main One Cable Company, a telecoms and data services company serving West Africa.

Tariye has a bachelor’s degree in Economics from Amherst College, and an MBA from the Harvard Business School

AISHAH AHMAD

Aishah Ahmad is Head Consumer Banking at Diamond Bank PLC, one of the fastest growing retail banks in Nigeria. She has responsibility for strategic retail products and customer segments including consumer banking, private wealth management, direct sales agent network with a customer base of over 5 million. Her professional experience spans 20 years and includes global financial institutions such as Stanbic IBTC Bank PLC -a member of Standard Bank Group, where she was responsible for Standard Bank’s private wealth business in West Africa, Bank of New York Mellon (UK), Zenith Bank PLC and NAL Bank PLC. A member of the Chartered Financial Analyst (CFA) and Chartered Alternative Investment Analyst (CAIA) Associations – both globally recognized programs for investment analysts and portfolio managers, Aishah holds a M.Sc. in Finance and Management from the Cranfield School of Management in the United Kingdom, an MBA with a specialization in Finance from the University of Lagos, Nigeria and a graduate degree in Accounting from the University of Abuja, Nigeria.

Aishah is passionate about global investing and promoting diversity & women’s (financial) inclusion; she regularly speaks on these topics and advises on the board of several companies. She is currently the Chairperson of the Executive Council of Women in Management, Business & Public Service, WIMBIZ (www.wimbiz.org); a leading women-focused not-for-profit organization in sub-Saharan Africa. She is also a member of the steering committee on Cherie Blair Foundation’s, Technology for Growth project; a groundbreaking learning intervention programme for female entrepreneurs in Nigeria, and was an alternate director at Friesland Campina WAMCO (2010 – 2014), a global company in the dairy industry.

ONONUJU IRUKWU

Ononuju Irukwu is the Managing Director, Chapel Hill Denham Management Limited, a leading Investment Management Company in Lagos, Nigeria. She is also the Chief promoter of the Women’s Investment Fund, an investment vehicle for Women initiated by Chapel Hill Denham Management Limited. She has over two decades of experience in Personal Banking and Wealth Management and is passionate about increasing financial literacy levels for women and youths. As part of her commitment to encouraging an investment culture among women, she writes a column, Your Personal Wealth, in ThisDAY Style magazine on Sundays and Your Money & You in TW magazine, where she shares tips on investing and planning your finances with a bias for issues women face when considering financial matters.

She is a graduate of the University of Benin and holds an MBA from the University of Ife ( Obafemi Awolowo University) both in Nigeria.

MODUPE MUJOTA

Modupe Mujota is currently the Managing Director at UBA Asset Management Limited, a leading firm in investment management and money market operations in Nigeria. Prior to this, she was the Managing Director at Kakawa Asset Management Limited (2011 – 2013) and also Managing Director of BGL Asset Management Limited prior to that, helming the affairs of another well-known brand in the investment management profession in the country.

During a distinguished career that has spanned over 20 years, she has held leadership and senior management roles in various areas in the Financial Services Industry including Commercial Banking, Asset Management, Corporate Finance and Risk Management. In her last two assignments she has garnered significant Corporate Governance experience seating on the Board of both investment management companies in capacity as Managing Director. She was instrumental in the development and establishment of Corporate governance practices in BGL Asset Management Limited and has also guided the return to profitability of Kakawa Asset Management Limited in the past year she assumed office.

OSARETIN AFUSAT DEMUREN

Osaretin Demuren is the Chairperson, Guaranty Trust Bank. She was confirmed 6th Chairman of the Board of Guaranty Trust Bank Directors in April this year. She joined Guaranty Trust Bank PLC in 2013 as a non-Executive Director and served as a member of the Board Risk Management Committee of which she became Chairman in 2014. She also served as a member of the Board Remuneration Committee and the Board Information Technology Strategy Committee. Prior to joining Guaranty Trust Bank, she served in the Central Bank of Nigeria for over 33 years at the Trade and Exchange Department, as member and secretary to the Public Enlightenment Committee on Second-tier Foreign Exchange Market, as a representative of the Central Bank of Nigeria on Special Investigation Panel on Trade Malpractices of the Federal Ministry of Commerce and Tourism and was appointed Director, Human Resource Department in 2004, a position she held until her retirement from the Central Bank in 2009 among many other roles. She is popularly known as the first female Director of CBN.

ADEOLA AZEEZ

Adeola Azeez is the Deputy Country Head of the Deutsche Bank Nigeria where she oversees the bank’s business operations including managing liaisons between the Deutsche Bank offshore and Nigerian banks. She has over 20 years’ expertise in correspondent banking. She was one of the founding members of Women In Management, Business and Public Service (WIMBIZ) and was elected in 2011 as the Chairperson of WIMBIZ. She has a bachelor’s degree in Philosophy from the University of Lagos and LLB from the University of Warwick.

Bunmi Lawson is the Pioneer Managing Director/CEO of ACCION Microfinance Bank Limited. ACCION Microfinance Bank Limited commenced operations under its pioneer Managing Director, Bunmi Lawson in 2007 with one branch and 18 members of staff. Today, ACCION Microfinance Bank has a total of 10 branches and with over 200 staff members. She is a co-owner and Director of VLA Lawrence & Associates, a Human Resource services organisation with over 18 years of experience in finance, insurance, marketing and auditing.

Before ACCION, she was the Executive Director of FATE Foundation Ltd, a leading business development service provider in Nigeria.

ARESE UGWU

Arese is the Founder of smartmoneyafrica.org a personal finance platform for the African millennial. As a contributor to the Guardian newspaper, the host on Guardian TV’s new personal finance show “Your Life Your Money”, and a co-host for “Analyse This” on Ndani TV, she has helped shape the new narrative on personal finance in the media.

She serves on several boards including House of Tara and the Nigeria Higher Education Foundation as a non-executive director, and is also an associate member of WIMBIZ, serving on its planning committee since 2015.

She was most recently a 2015 finalist for the Access Bank W Award for young professional of the year. After eight years working in wealth management, Arese is now engaging young Africans on the importance of financial literacy and the impact it has on helping them get money, keep money and grow money as they drive the continent forward.

CHINYERE DON-OKHUOFU

Chinyere is the Divisional Chief Executive Officer of Industry Vertical Markets at Interswitch Limited. She is a visionary, motivating leader with deep knowledge of the Retail and Electronic Payments businesses. Her professional career has been marked with remarkable leadership roles that have transformed her projects and organizations. Prior to joining Interswitch, she was the Divisional Head of Branch Banking and Electronic Banking at Intercontinental Bank Plc. (now Access Bank), where she spent 17 years of her banking career in various business units. She and her team re-defined the Offsite ATM landscape in Nigeria through the effective deployment of her banks ATMs in various locations across the country thus pushing her bank to the number 1 bank in total transactions within a year on the Interswitch platform.

Mrs Alade is the former Acting Governor of the Central Bank of Nigeria on 20th February, 2014. Prior to this time, she had served as Deputy Governor (Economic Policy), Central Bank of Nigeria from 26th March, 2007. Sarah Alade commenced her working career in 1977 with the Ministry of Finance and Economic Development, Ilorin, Kwara State. In 1991, she joined the University of Ilorin as a Lecturer in the Department of Accounting and Finance. She joined the Central Bank of Nigeria in 1993 as an Assistant Director in the Research Department where she served as Head, State Government Finance Office (1993-1996), Head, Federal Government Finance Office (1996-2000) and Head, Fiscal Analysis Division (2000-2004).

Dr. Alade has served on the teams on major economic policy studies, and has been involved in the preparation of Central Bank of Nigeria’s Monetary and Credit Policy Proposals over the years. She was actively involved in the drafting of the Medium Term Economic Programme (MTP) for Nigeria and the IMF staff Monitored Programme/Standby Arrangement.

Dr. Alade, who is a member of the Nigerian Economic Society (NES), has several publications to her credit and is currently carrying out research into Interest Rate Policy and Monetary Policy Implementation in Nigeria.

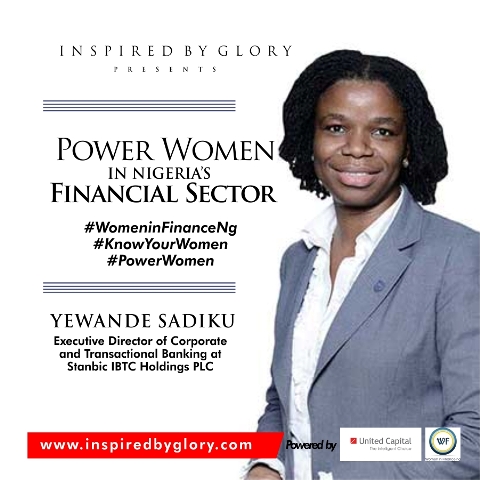

YEWANDE SADIKU Yewande is the Executive Director of Corporate and Transactional Banking at Stanbic IBTC Holdings PLC. Prior to this, she served as the Chief Executive of Stanbic IBTC Capital Limited. Ms. Sadiku served as the Head of Finance Department of Stanbic IBTC Bank Plc (formerly, IBTC Chartered Bank Plc).

Yewande is the Executive Director of Corporate and Transactional Banking at Stanbic IBTC Holdings PLC. Prior to this, she served as the Chief Executive of Stanbic IBTC Capital Limited. Ms. Sadiku served as the Head of Finance Department of Stanbic IBTC Bank Plc (formerly, IBTC Chartered Bank Plc).

Mrs Akinkugbe is the Founder/ Chief Executive Officer of Bestman Games Ltd, the African distributor of customized editions of Monopoly, Hasbro’s world famous game. Prior to this she enjoyed a successful banking career spanning 23 years first at Stanbic IBTC Bank Plc where she rose to the position of General Manager and Head, Private Banking and Director Stanbic IBTC Asset Management Ltd. Subsequently she joined Barclays Bank Plc as Regional Director (West Africa) for the Wealth & Investment Management Division and Chief Country Officer for Nigeria.

Achieving financial security ranks as a major source of anxiety and Nimi seeks to empower people regarding their finances. Under the auspices of the brand “Money Matters with Nimi,” through speaking engagements, television and radio appearances and social media, the Monopoly Board Games and her new book, “A – Z of Personal Finance”, Nimi provides frank, practical insights to create a greater awareness and understanding of personal finance and wealth management issues. Through these platforms, she has been able to empower people to take responsibility for this most important aspect of their lives

MARYAM BASHIR

Maryam Bashir (also known as Mairo), is the Chief Executive Officer of CreditCorp Ltd, a consulting and advisory services firm. Mairo has over seventeen years of financial and banking industry experience.

In 2004, she founded Creditcorp Limited. Ms. Bashir served in various management positions in UBA. Prior to UBA, she started her banking career in 1985 with the International Merchant Bank (IMB), working in various functions in Credit & Marketing and Operations divisions. She holds an MBA in Finance from the University of Jos.

HAJARA ADEOLA

Hajara Adeola heads Lotus Capital Limited, a Nigerian pioneer in Shari’ah compliant Asset Management, Private Wealth Management Advisory Services and Financial Advisory Service. She began her career as a consultant at Andersen Consulting (now Accenture). From there she joined ARM Investment Managers as a pioneer staff and rose to Vice-President and Head of the Research and Financial Advisory Units. She has over 20 years of international experience in research and analysis, investment management and corporate finance. Mrs. Adeola is the former President of the Fund Manager’s Association of Nigeria

CHINELO ANOHU-AMAZU

Mrs. Chinelo Anohu-Amazu, a lawyer, obtained an LL.B degree from the University of Nigeria, Enugu Campus in 1996, a B.L from the Nigerian Law School in 1997 and an LL.M in Computer and Communications Law from the London School of Economics in 2000. Mrs. Anohu-Amazu also studied in many prestigious institutions such as the Columbia University Graduate School in 2008, the J. F. Kennedy School of Government of the Harvard University in 2007 and the Wharton Business School, University of Pennsylvania in 2002. Mrs. Anohu-Amazu has been the Director-General of the National Pension Commission from 14 December, 2012 till date.

You may like

Snoring disrupts sleep for both the person snoring and their partner, lowering overall sleep quality. It’s more than a nighttime nuisance—it often signals health concerns like sleep apnea. Learning how to stop snoring is essential for better sleep and improved health.

To stop snoring, start by addressing your sleep position. Sleeping on your back can worsen snoring as gravity pulls the tongue and soft tissues backward, narrowing the airway.

Shift to your side to improve airflow. Another effective method for how to stop snoring is maintaining a healthy weight. Excess fat, especially around the neck, constricts breathing passages.

Lifestyle choices also matter. Avoid alcohol and sedatives before bedtime, as they relax throat muscles, making snoring worse.

Staying hydrated is another simple tip for how to stop snoring, as dryness thickens the mucus in the throat. For nasal congestion, saline sprays or humidifiers can keep airways open.

In severe cases, consult a doctor. Conditions like sleep apnea may require treatments such as CPAP machines or surgery.

Committing to these strategies can show you how to stop snoring effectively, transforming your sleep quality and overall well-being.

1. Lifestyle Modifications

- Weight Management: Excess weight, particularly around the neck, can contribute to snoring. Weight loss can alleviate this issue.

- Dietary Adjustments: Limiting alcohol and sedatives can relax the throat muscles, increasing the likelihood of snoring. A balanced diet can also help maintain overall health.

- Smoking Cessation: Smoking irritates the airways, making snoring worse. Quitting smoking can improve respiratory health and reduce snoring.

- Optimal Sleep Posture: Sleeping on your back can worsen snoring. Side sleeping or using a special pillow designed to keep you in a side position can be beneficial.

2. Over-the-Counter Remedies

- Nasal Strips: These adhesive strips can help open nasal passages, reducing snoring caused by nasal congestion.

- Oral Appliances: Mouthguards or dental devices can help keep the airway open during sleep. Consult a dentist for a proper fit.

3. Medical Interventions

If lifestyle changes and over-the-counter remedies are ineffective, consulting a healthcare provider is recommended. They may suggest:

- Continuous Positive Airway Pressure (CPAP): A machine that delivers pressurised air to keep the airway open during sleep.

- Surgery: In severe cases, surgical procedures may be necessary to correct structural issues in the throat or nose.

If you or your partner notices loud, frequent snoring, especially accompanied by symptoms like daytime sleepiness, choking sounds, or gasping for air, it’s crucial to seek medical advice. Prompt diagnosis and treatment can improve your overall health and quality of life.

By implementing these strategies and seeking professional help when needed, you can enjoy quieter nights and a healthier sleep pattern.

For more reads, visit here.

Ancient African beauty practices were rooted in nature and culture, blending self-care with physical well-being. These timeless rituals passed through generations continue to inspire modern beauty techniques.

Here are five remarkable practices:

1. Shea Butter for Skin and Hair Care

Shea butter, extracted from the nuts of the shea tree, is a staple in West Africa, especially in Nigeria and Ghana. Rich in vitamins A and E, it deeply moisturises the skin, promotes healing, and protects against harsh weather.

Traditionally, it was also used on hair to enhance growth and provide nourishment. Its soothing properties made it a remedy for burns and skin conditions, showcasing its therapeutic significance.

2. African Black Soap: Nature’s Cleanser

African black soap, made from plantain skins, cocoa pods, and palm tree leaves, has been a cornerstone of skincare for centuries.

Originating in Nigeria and spreading across West Africa, this soap is celebrated for its ability to cleanse deeply, exfoliate, and treat skin issues like acne and eczema.

Its natural ingredients make it a gentle yet effective solution, emphasising the continent’s resourcefulness in creating sustainable beauty products.

3. Mud and Clay Masks for Detoxification

Mud and clay have been integral to African beauty routines, especially in North and East Africa. These natural elements were used for their detoxifying properties, helping to draw out impurities while rejuvenating the skin.

The minerals in these masks improved skin tone and offered a calming and meditative experience. In regions like Morocco, Ghassoul clay became famous for hair and skin treatments, adding shine and vitality.

4. Beads and Piercings as Adornments

Beads and piercings were more than decorative; they symbolised identity, status, and spirituality. Waist beads, ankle bracelets, and body piercings were used to signify tribal affiliations, beauty, and even fertility.

This practice, prominent across Africa, highlights the continent’s artistry and the cultural significance of body adornments.

5. Dry Brushing and Natural Oils

Dry brushing, practiced in ancient Egypt, was a technique for exfoliating the skin, improving circulation, and promoting a glowing complexion.

Similarly, oils like Kalahari melon seed oil in Southern Africa provided hydration and protection against harsh climates. These practices were holistic, blending skincare with overall wellness.

These ancient African beauty practices demonstrate the rich heritage of natural and sustainable self-care. By embracing earth-based ingredients and methods, Africans nurtured beauty that was as functional as it was symbolic.

These traditions continue to resonate today, inspiring global beauty trends and connecting modern practices to their ancestral roots.

Would you like to read more on beauty? Visit here.

Nigeria spreads its economic opportunities across 36 dynamic states. As living costs continue to rise in major cities in Nigeria, smart residents now seek out the cheapest states to live in. Each state offers unique advantages for budget-conscious individuals and families.

Housing costs vary dramatically between regions. The cheapest states to live in Nigeria provide affordable housing options for both renters and homeowners. Food prices, transportation costs, and utility expenses also play crucial roles in determining overall living expenses.

Recent economic surveys have identified the 5 cheapest states to live in Nigeria through comprehensive cost analysis. These states maintain lower prices for essential goods and services.

Local markets in these regions offer fresh produce at reasonable prices. Transportation networks operate efficiently with competitive fares. Healthcare facilities provide services at manageable costs.

Young professionals and families increasingly migrate to these affordable regions. The cheapest states to live in Nigeria attract people seeking financial stability without compromising quality of life.

These states balance economic opportunities with reasonable living expenses. Their growing communities demonstrate that comfortable living doesn’t require excessive spending.

1. Benue State

Farmers cultivate vast lands across Benue State’s fertile soil. Local markets overflow with fresh yams, cassava, and vegetables at remarkably low prices.

Residents enjoy affordable three-bedroom apartments for less than ₦300,000 yearly in major towns. Transportation costs remain low due to the state’s robust road network. The state government maintains policies that keep basic amenities affordable.

Local communities embrace communal living, which further reduces daily expenses. Educational institutions offer competitive fees for quality education.

2. Delta State

Delta State balances its oil wealth with affordable living costs. Local markets sell fresh fish and farm produce at budget-friendly prices.

Housing developers offer reasonable rental options in developing areas. Small businesses thrive in the state’s mixed economy.

Transportation services operate at competitive rates across cities. The state maintains several affordable healthcare facilities.

Cultural festivals and community markets help keep entertainment costs low. Local government initiatives support affordable housing schemes.

3. Katsina State

Katsina’s traditional markets offer essential goods at reduced prices. Local architecture favours cost-effective housing solutions. The state’s agricultural sector provides affordable food options.

Public transportation runs efficiently with minimal costs. Community living reduces individual expenses significantly. Local craftsmen offer services at reasonable rates.

The state’s educational system maintains affordable fee structures. Healthcare centres provide low-cost medical services.

4. Sokoto State

Sokoto combines historical richness with economic affordability. The leather industry provides employment and affordable products. Local housing reflects traditional designs with low maintenance costs.

Markets offer diverse goods at competitive prices. Public services remain accessible and affordable. The state’s educational institutions maintain reasonable fee structures.

Transportation costs stay low due to efficient networks. Community healthcare centres provide budget-friendly services.

5. Zamfara State

Zamfara promotes affordable rural living through various initiatives. Local markets offer essential goods at reduced prices. Housing costs remain significantly lower than in urban areas.

The agricultural sector provides affordable food options. Community-based services help reduce living expenses. Public transportation operates at minimal costs. The state maintains affordable healthcare facilities.

Education remains accessible through low-cost schools. Recent security improvements have stabilized living costs in many areas.

Factors Affecting Cost of Living in Nigeria

Several factors influence the cost of living in Nigeria:

- Location: Urban areas like Lagos and Abuja tend to be more expensive than rural areas.

- Lifestyle: Personal preferences, such as housing choices, transportation options, and dining habits, significantly impact living costs.

- Currency Exchange Rates: Fluctuations in the exchange rate can affect the cost of imported goods.

- Inflation: Rising inflation can erode purchasing power and increase the cost of living.

- Security: Security concerns in certain regions can impact the cost of living, as additional security measures may be necessary.

Tips for Affordable Living in Nigeria

- Choose Affordable Housing: Opt for more affordable housing options like apartments or shared accommodation.

- Cook at Home: Preparing meals at home can significantly reduce food costs.

- Utilize Public Transportation: Public transportation is generally more affordable than private vehicle ownership.

- Shop Wisely: Compare prices and look for deals to save money on groceries and other essentials.

- Budgeting: Create a budget and stick to it to manage finances effectively.

By carefully considering these factors and implementing cost-saving strategies, individuals can enjoy a comfortable and affordable lifestyle in Nigeria.

For more articles, visit here.

Latest

How To Stop Snoring When Sleeping

Snoring disrupts sleep for both the person snoring and their partner, lowering overall sleep quality. It’s more than a nighttime...

5 Awesome Ancient African Beauty Practices

Ancient African beauty practices were rooted in nature and culture, blending self-care with physical well-being. These timeless rituals passed through...

5 Cheapest States To Live In Nigeria

Nigeria spreads its economic opportunities across 36 dynamic states. As living costs continue to rise in major cities in Nigeria,...

Here Are The 5 Oldest Tribes In Nigeria

Over 250 ethnic groups thrive within Nigeria, making it one of Africa’s most ethnically diverse countries. Among these ethnic groups,...

Nicki Minaj Features Davido On “The Pink Print” 10th Anniversary Edition

Nigerian superstar Davido has joined forces with Nicki Minaj for an exciting new track. The collaboration appears on the 10th-anniversary...

Falz Speaks About His Worst Date Experience

Nigerian rapper Falz recently shared a humorous yet awkward story from one of his early dating experiences. During an interview...

“Everybody Loves Jenifa” Can Beat ₦5 Billion – Funke Akindele

Funke Akindele aims to achieve a record-breaking ₦5 billion in ticket sales with her new film, Everybody Loves Jenifa, set...

Wizkid Releases His Highly Anticipated Album, “Morayo”

After months of anticipation, Wizkid has finally dropped his highly awaited eighth project and sixth studio album, Morayo. He named...

Lee Min-Ho Returns To The Big Screens In Netflix’s “When The Stars Gossip”

Lee Min-ho is set to make a triumphant return to the big screens with Netflix’s upcoming South Korean series When...

Wizkid’s “Dance” Reappears On Apple Music Nigeria Top 100

Wizkid’s ‘Kese (Dance)’ Reclaims Top Spot on Apple Music Nigeria Wizkid’s latest single, ‘Kese (Dance)‘ dramatically returned to the Apple...

-Ad-

12 Daily Habits That Cause Mouth Odour Even After Brushing

Learn How To Cook Efo Riro Soup With This Easy Recipe

Do Bras Really Keep Breasts From Sagging? Check This Out!

See Cute Saint’s Collection At Lagos Fashion Week 2024

Meet Efunroye Tinubu, The Influential Slave Trader Who Controlled Lagos

Davido Debuts On Lagos Fashion Week Runway For Ugo Monye

3 Eggless Cake Recipes To Try At Home

Veekee James Claps Back At Troll Who Insulted Her Looks

5 Most Affordable Places To Eat Pasta In Lagos

5 Reasons Some Women Experience Stomach Pain After Sex

Trending

-

TRAVEL7 days ago

TRAVEL7 days ago10 Fun Places You Can Visit In Abuja With Just 5k

-

BUSINESS6 days ago

BUSINESS6 days ago6 Things To Consider Before Starting A Business In Nigeria

-

FOOD7 days ago

FOOD7 days ago6 Creative Ways To Make The Most Of Rice In Nigeria

-

MOVIES5 days ago

MOVIES5 days ago“The Interrogation Of Lotanna” Bags 6 Nominations At The FilmJoint Awards 2025

-

INTERNATIONAL3 days ago

INTERNATIONAL3 days ago“Gladiator II” Records ₦99.1 Million In Its Opening Weekend At The Nigerian Box Office

-

SEX6 days ago

SEX6 days agoDid You Know Oral Sex Can Be Harmful? Here’s Why

-

FASHION6 days ago

FASHION6 days agoHow The Speedy Bag Became A New Menswear Favourite

-

MOVIES6 days ago

MOVIES6 days agoCheck Out The Trailer For Femi Adebayo’s Directorial Debut, “Seven Doors”