FOREIGN

Oil rich Saudi Arabia to build world’s largest solar power plant

Published

7 years agoon

By

Reporter

AL UYAYNA: Saudi engineers whip up a simulated sandstorm to test a solar panel’s durability at a research lab, the heart of the oil-rich kingdom’s multi-billion dollar quest to be a renewable energy powerhouse.

The world’s top exporter of crude seems an unlikely champion of clean energy, but the government lab in Al Uyayna, a sun-drenched village near Riyadh, is leading the country’s efforts for solar power as it seeks to diversify.

A dazzling spotlight was shone on those ambitions last week when Crown Prince Mohammed bin Salman unveiled plans to develop the globe’s biggest solar power project for $200 billion in partnership with Japan’s SoftBank group.

Bahrain makes largest oil discovery in its history

The memorandum of understanding to produce up to 200 gigawatts of power by 2030 – about 100 times the capacity of the current biggest projects – was the latest jaw-dropping statement as the Saudis look to wean themselves off oil.

If built on one site, the solar farm would cover an area twice the size of Hong Kong, according to a Bloomberg News calculation.

While the scale of the plan has stirred some disbelief – the agreement announced in the US was greeted with determination at the laboratory.

“We can do it,” said Adel al-Sheheween, director of the solar laboratory under the King Abdulaziz City for Science and Technology.

“This may take time, but we have all the raw materials – sunshine, land and most importantly, the will,” he added, giving AFP a tour of the facility widely known as Solar Village.

Engineers were working away testing solar panels under harsh conditions.

A miniature sandstorm inside a cylindrical chamber battered one panel. A machine with what appeared to be a large boxing glove punched another.

The site, which also includes a solar field that supplies electricity to neighbouring villages, was established some three decades ago.

But the push for renewables only now appears to be gaining momentum.

It is driven by a key incentive – to free up more oil reserves for export, the kingdom’s chief revenue earner.

Saudi Arabia currently draws on oil and natural gas to both meet its own fast-growing power demand and desalinate its water, consuming an estimated 3.4 million barrels of oil daily.

That number is expected to rise to 8.3 million barrels in 10 years, according to the King Abdullah City for Atomic and Renewable Energy, eating up the bulk of Saudi Arabia’s crude production.

“Saudi Arabia has long had a vision for becoming… an exporter of oil and of gigawatts of power,” Ellen Wald, a scholar at pro-Saudi think tank Arabia Foundation and author of the book “Saudi Inc”, told AFP.

“That vision requires solar power installations of a massive scale. My understanding is the project will be rolled out in pieces and not as one giant plant.”

But the sheer scope of the project, which aims to produce well above the kingdom’s own projected requirement of 120 gigawatts by 2032, has prompted scepticism.

“Although Saudi Arabia has more than enough vacant, non-arable desert land… (it) really does not need so much solar power,” said Bart Lucarelli, a managing director for power and utilities at advisory firm AWR Lloyd.

“There has been speculation about whether this amount of new solar capacity can even be built in that time frame within a single country.

The consensus view is that the 200 gigawatt figure is excessive.”

Lucarelli said Saudi Arabia instead “needs a balance” between renewables and fossil fuels – and pointed out that the solar memorandum is non-binding for now.

To handle the amount of power the project envisions, experts say the kingdom would require huge investments to upgrade its grid and set up large-scale battery storage facilities.

The solar push appears to be driven by geopolitics as much as economics.

Saudi prince says Israel has ‘right’ to its land

“Saudia Arabia’s problem is that (rivals) Iran and Qatar have the gas reserves it does not,” said James Dorsey, a Middle East expert at the S. Rajaratnam School of International Studies in Singapore.

“That is one reason why renewables figure prominently in Prince Mohammed’s reform programme, not only to prepare Saudi Arabia economically for a post-oil future but also to secure its continued geopolitical significance.”

Saudi Arabia also harbours atomic ambitions, with plans to build 16 reactors over the next two decades for $80 billion, despite concerns over nuclear proliferation in the Middle East.

But the economics favour solar power. Electricity from solar sources costs less than half that of nuclear power.

SoftBank’s Vision Fund would invest $1 billion for the first phase of the deal, but it is unclear where the rest of the investment will come from.

Saudi Arabia has dazzled investors with several plans for hi-tech “giga projects”, funded in part by its sovereign wealth fund, but sceptics question their viability in an era of cheap oil.

The kingdom has unveiled blueprints to build NEOM, a mega project billed as a regional Silicon Valley, in addition to the Red Sea project, a reef-fringed resort destination – both worth hundreds of billions of dollars.

“Throwing money at a project, be it a solar project or a tech city, won’t make it work unless it’s accompanied by technology that works and effective project management,” said Wald.

“Most likely, the end result of mega projects will be markedly different than the vision expressed today. That is not to say worse, but different.”

You may like

-

2034 World Cup Set To Hold In Saudi Arabia

-

Saudi Arabia says Ramadan fasting to begin on Thursday

-

Netanyahu says Saudi to open airspace to India-Israel flights

-

Saudi Arabia Becomes First Country to Grants Citizenship To A Robot

-

Women Can Now Drive In Saudi Arabia, King Salman Issues Decree

-

Saudi Arabia Lifts Ban On Skype, WhatsApp Voice Calls and Other Messaging App

FOREIGN

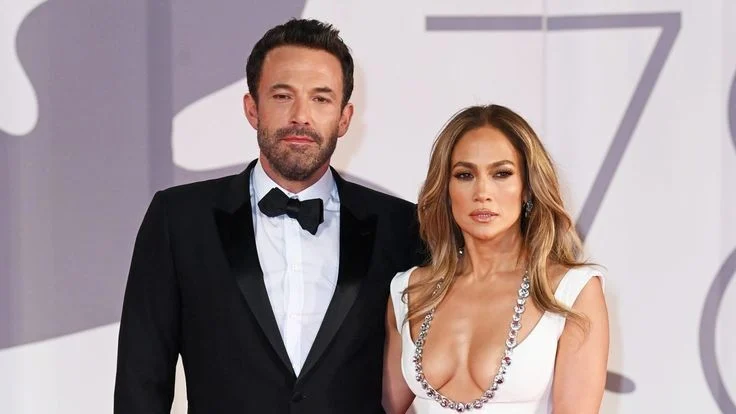

Ben Affleck & Jennifer Lopez Officially Finalise Divorce Settlement 2 Years After Marriage

Published

2 months agoon

January 7, 2025By

Reporter

Jennifer Lopez and Ben Affleck will finalise their divorce on February 20, 2025, following a mutual agreement confirmed in court documents obtained by E!

News on January 6. The couple reached an amicable settlement that allows each party to retain their individual earnings from their two-year marriage, with no spousal support requirements.

Lopez filed for divorce in Los Angeles on August 20, 2024, citing April 26, 2024, as their separation date. The filing date coincidentally aligned with the anniversary of their 2022 wedding ceremony in Georgia, which followed their initial Las Vegas elopement.

The settlement stipulates that Lopez will revert to her maiden name after previously changing it to Affleck during their marriage. Ben Affleck and Jennifer Lopez agreed to the terms without dispute.

Their relationship history spans over two decades, beginning on the set of their film “Gigil” in 2002. At that time, Lopez was married to her second husband, Cris Judd. Following her divorce from Judd in 2003, Lopez and Affleck publicly announced their relationship.

Lopez’s marriage to Affleck marked her fourth union. Her previous marriages include a brief partnership with Ojani Noa (1997-1998). Marriage to Cris Judd (2001-2003) followed. Furthermore, a decade-long marriage to Marc Anthony (2004-2014) produced twins.

Between her marriages, Lopez maintained a high-profile relationship with former baseball player Alex Rodriguez from 2017 until their engagement ended in 2021.

The 55-year-old Lopez and 52-year-old Affleck’s divorce proceedings concluded a relationship that garnered significant public attention.

This is throughout its various phases, from their initial meeting in 2002 to their reunion and subsequent marriage in 2022.

Check out more updates here.

FOREIGN

Beyoncé Achieves Historic Milestone As Most Certified Female Artist

Published

3 months agoon

December 19, 2024By

Reporter

Renowned singer Beyoncé has solidified her position as the most certified female artist of all time, a distinction bestowed upon her by the Recording Industry Association of America (RIAA).

Her recent surge in song certifications has propelled her to an impressive total of 103 RIAA-certified titles, surpassing all other female artists in this category.

The RIAA celebrated this monumental achievement in a post on X on Tuesday.

“Crowning achievement! Congratulations to @Beyonce, who now holds the record for the most certified titles for a female artist in RIAA history, including her first two Diamond singles! @parkwood @columbiarecords,” RIAA announced in a post on X on Tuesday.

Crowning achievement! Congratulations to @Beyonce, who now holds the record for the most certified titles for a female artist in RIAA history, including her first two Diamond singles!

@parkwood @columbiarecords pic.twitter.com/L86gwGkzQN

— RIAA (@RIAA) December 17, 2024

Among her numerous accolades are Diamond certifications for two iconic singles: “Halo” and “Single Ladies (Put a Ring on It).” These certifications signify extraordinary sales and streaming figures.

Additionally, Beyoncé boasts a string of impressive certifications for her albums. “Renaissance” has achieved 2x Platinum status, “Lemonade” has attained 4x Platinum, and both “Sasha Fierce” and “Dangerously In Love” have earned 7x Platinum certifications.

This latest milestone further solidifies Beyoncé’s legacy as one of the most influential and successful artists of all time.

Her ability to consistently deliver groundbreaking music that resonates with audiences worldwide has undoubtedly contributed to her unparalleled success.

Check out more music updates here.

FOREIGN

“Gladiator II” Becomes Denzel Washington’s Most Successful Movie With $320 Million Worldwide Gross

Published

4 months agoon

December 4, 2024By

Reporter

Known as one of Hollywood’s most respected figures, Washington has built an extraordinary career filled with iconic performances and critical acclaim.

His influence extends far beyond Hollywood, earning him global admiration. However, despite his illustrious career, Washington has not always been the first name associated with record-breaking box office success compared to some of his contemporaries.

His recent collaboration with Ridley Scott has now changed that narrative. Gladiator II has shattered expectations, becoming Washington’s highest-grossing film worldwide.

The movie has earned an impressive $320.2 million globally. This surpasses his previous record-holder, American Gangster, which grossed $267.9 million.

This milestone solidifies Gladiator II as Washington’s most financially successful film directed by Scott.

Domestically, American Gangster has maintained its position as Washington’s top-earning film for 17 years, with a domestic gross of $130.1 million.

However, this record may soon be eclipsed by Gladiator II, which has already reached $111.4 million domestically and continues to draw large audiences.

The success of Gladiator II marks a significant achievement in Washington’s career. It shows his enduring appeal and the powerful collaboration with Ridley Scott.

This box office triumph not only highlights Washington’s versatility and star power but also sets a new benchmark for future projects.

Fans and industry insiders alike are watching closely, anticipating how far this latest release will go in redefining the actor’s box office legacy.

Throughout his decades-long film career, Washington has taken on a variety of action roles, many of which have been box-office successes.

The Equaliser franchise, for instance, has grossed approximately $190 million worldwide per installment.

Even some of his less critically acclaimed films, such as 2012’s Safe House, achieved significant commercial success, grossing $208.1 million against a budget of $85 million.

Latest

Samsung Galaxy S25 Series Sets The Standard Of AI Phones As A True AI Companion

Samsung Galaxy S25 series sets the standard of AI phones as a true AI companion …Pioneering the multimodal era with...

5 Things To Expect In Afrobeats In 2025

Afrobeats is poised to reach unprecedented heights in 2025 as Nigerian music continues its remarkable global ascent. The genre’s explosive...

Here Are The 7 Most Ancient Countries On Earth

The oldest countries in the world stand as remarkable testaments to human civilisation, each containing landscapes and monuments that narrate...

Why Self-Reflection Is More Important Than Resolutions

Millions of people embark on a yearly ritual: they sit down with a notebook and pen, eager to craft a...

Nollywood Director, Kemi Adetiba Teases King Of Boys 3

Nollywood director Kemi Adetiba has revealed that another instalment of King of Boys will be released on December 25, 2025....

John McEnroe Says He Can Be The Commissioner Tennis Needs Amid Doping Crisis

Recent doping controversies involving top players have not damaged tennis’s reputation, but John McEnroe believes that appointing a single commissioner...

“Everybody Loves Jenifa” Becomes Nollywood’s Highest-Grossing Film Of All Time

Nollywood filmmaker Funke Akindele has achieved a historic milestone with her latest film, “Everybody Loves Jenifa.” The film has officially...

FG To Premiere TV Series, “Hidden Riches” On Mining Sector On January 25

Nigeria’s Federal Government will launch an ambitious television drama series focused on the nation’s mining sector, premiering “Hidden Riches” on...

Qing Madi Delivers A Soulful Performance Of “Favourite Pyscho”

Rising Afro-RnB sensation Qing Madi launches into 2025 with a mesmerising performance on the prestigious COLOURS platform, showcasing her latest...

Taiwo Awoniyi’s First Goal Of The Season Seals Nottingham Forest’s Win Over Wolves

Taiwo Awoniyi made a triumphant return to Premier League action. He scored in stoppage time to help Nottingham Forest crush...

-Ad-